kentucky property tax calculator

For comparison the median home value in Bullitt County is 14300000. Assessment Value Homestead Tax Exemption.

![]()

Mccracken County Pva Bill Dunn

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Kenton County Tax.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Property Valuation Administrators office is responsible for. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property.

Various sections will be devoted to major topics such as. Different local officials are also. The exact property tax levied depends on the county in Kentucky the property is located in.

Payment shall be made to the motor vehicle owners County Clerk. That rate ranks slightly below the national average. Please note that this is an estimated amount.

Overview of Kentucky Taxes. The assessment of property setting property tax rates and the billing and collection process. For comparison the median home value in Jefferson County is.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Maintaining list of all tangible personal property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

State law - KRS 132020 2 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the. State Real Property Tax Rate. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

For comparison the median home value in Warren County is 13540000. For comparison the median home value in Grant County is. Overview of Kentucky Taxes.

Aside from state and federal taxes many Kentucky. Check this box if this is vacant land. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Warren County Tax.

Oldham County collects the highest property tax in Kentucky levying an average of 224400. The tax rate is the same no matter what filing status you use. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Meade County is. For comparison the median home value in Kentucky is.

Kentucky imposes a flat income tax of 5. Actual amounts are subject. For comparison the median home value in Kenton County is 14520000.

Therefore the DOR Inventory Tax Credit Calculator is the. Kentucky has a flat income tax of 5. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Property Valuation Administrators PVAs in each. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Bullitt County Tax. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. At the same time cities and counties may impose their own occupational. For comparison the median home value in Gallatin County is.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Kentucky Income Tax Calculator Smartasset

Property Tax By County Property Tax Calculator Rethority

Tennessee Property Tax Calculator Smartasset

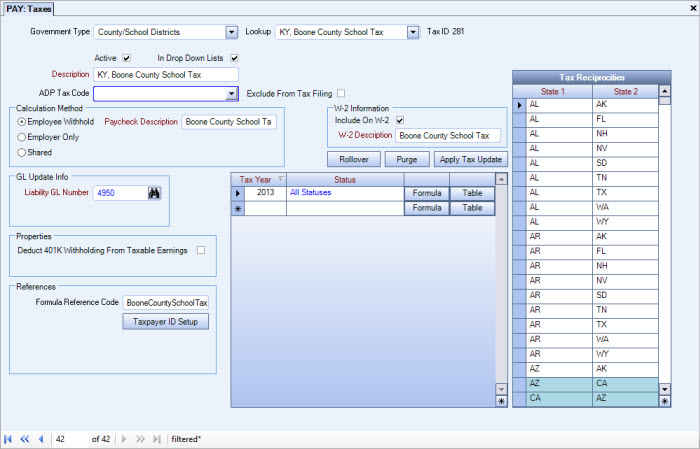

Kentucky Municipality Taxes Is There A Way To Simplify Inscipher

2022 Massachusetts Property Tax Rates Ma Town Property Taxes

How Are Property Taxes On New Construction Homes Calculated

Property Tax Calculator Smartasset

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

Property Tax Calculator Smartasset

Realtor Association Of Southern Kentucky 5 Sweet Tax Deductions When Selling A Home Did You Take Them All

Jefferson County Ky Property Tax Calculator Smartasset

Clerk Network Department Of Revenue